Advertisement

Let us understand the compounding effect of investing in the National Pension Scheme (NPS) with a simple example. Monthly contribution of ₹10,000, an annual return of 14%, and keeping contributing same amount for next 30 year

Assumptions

Contribution Starting at age of 30, and investor is aggressive, hence it is assumed that 14% Return per year.

- Annual contribution = ₹1,20,000

- Annual return (r) = 14% or 0.14

- Investment period (n) = 30 years

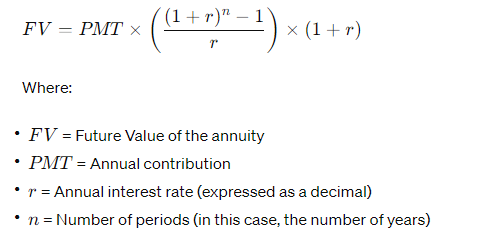

So, the compounded value of the investment, after 30 years with an annual contribution of ₹1,20,000 and an annual return of 14%, would be approximately ₹48,808,4416.

In Conclusion : Investment of 36Lakhs becomes 488Lakhs or 4.88Cr

See yourself or Try yourself :